WHAT IS BAD DEBTS? HOW TO CHECK BAD DEBTS BANK

1. What is bad debt?

Bad debt is understood as bad debt when the borrower is unable to pay the debt when it is due to pay as committed in the credit contract. Specifically, if the payment is overdue for more than 90 days, it is considered a bad debt.

Those who are identified as bad debt will be listed in the list of bad debt customers on the system of the Vietnam National Credit Information Center CIC.

The current way of determining bad debt is according to the provisions of Clause 8 Article 3 and Article 10 of Circular 11/2021/TT-NHNN.

2. How to check bank bad debt (online)

There are 02 ways to check bad debt online banking. Check at the website of Vietnam National Credit Information Center CIC or check with CIC application on mobile device.

2.1 How to check bad debt on CIC website

- Step 1: Access CIC website https://cic.gov.vn/#/register

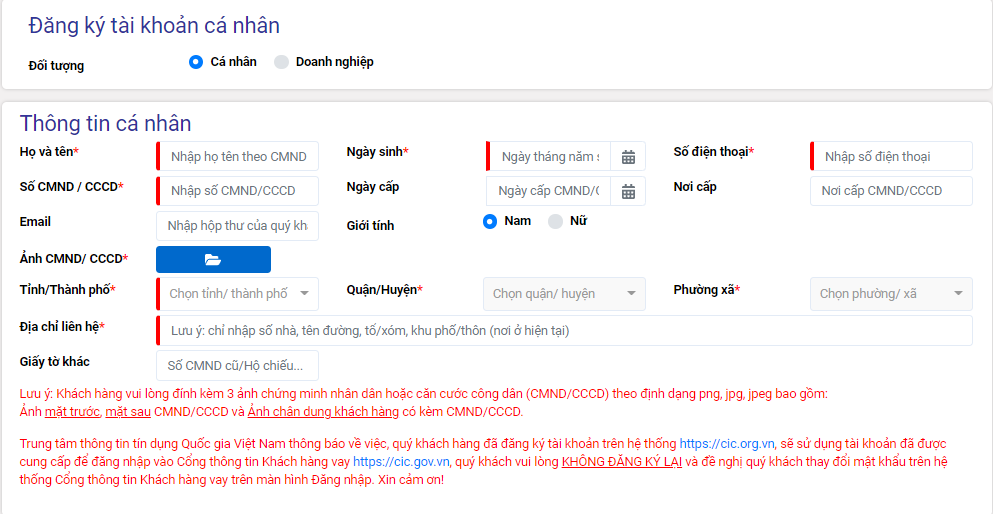

- Step 2: Follow the instructions to register, including personal information, ID image, etc.

How to check bad debt on CIC website (Artwork)

- Step 3: Enter “Password” and “Confirm Password”, then click “Continue”

- Step 4: Enter the OTP code sent to the registered phone number, then press "continue"

- Step 5: CIC staff will call you to verify information via question and answer form

- Step 6: After creating an account successfully, registration results, username and password will be sent via SMS/Email.

- Step 7: Log in to the CIC system, and check the credit history in the personal information section.

2.2 How to check bad debt using CIC application on mobile phone

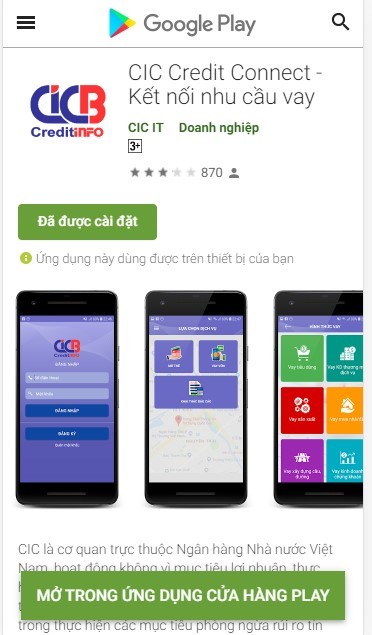

The CIC Credit Connect application is now supported to be installed on both iOS and Android operating systems. The bad debt searcher performs the following steps:

- Step 1: Download and install CIC application for your phone.

How to check bad debt using CIC application on mobile phone (Artwork)

- Step 2: Register for a CIC account according to the required steps of the system

- Step 3: Log in to your account when CIC approves it successfully. The review process may take 1-3 business days.

- Step 4: Use the lookup feature to check bad debt according to the required steps of the system

- Step 5: Get the search results

Regardless of how the bad debt check is performed, after completing the search, the CIC system will send the searcher a detailed report on the credit history. Information on the report will include: personal credit score, current debt, which debt is bad debt, credit history, credit relationships...

Related article

- ASSESSMENT OF THE VALUE OF ELECTRICITY WORKS

- WHAT IS ASSESSMENT CERTIFICATE? VALIDITY OF ASSESSMENT CERTIFICATE?

- CONSTRUCTION INVESTMENT PROJECT ASSESSMENT PROCESS

- VALUATION OF LAND AT MARKET PRICE TO AVOID SPECULATIVE

- VALUATION OF THE FINANCIAL STATUS OF THE BUSINESS

- VALUATION OF PROPERTIES WHEN SETTLE ABROAD

VI

VI